The gaming industry has witnessed a significant shift in recent years with the rise of play-to-earn (P2E) models and decentralized economies. At the heart of many blockchain-based games lies the concept of guild tokens, which serve as the lifeblood of in-game economies. However, as these ecosystems mature, developers face a critical challenge: how to maintain token value over time. This has led to the emergence of sophisticated token deflationary models designed to combat inflation and ensure long-term sustainability.

Understanding Guild Token Inflation

In traditional gaming economies, unlimited token minting often leads to severe inflation, rendering rewards meaningless over time. Blockchain games initially fell into the same trap, with many early projects seeing their token values plummet as supply outstripped demand. The problem becomes particularly acute in guild systems where thousands of players earn tokens simultaneously through gameplay. Without proper mechanisms to remove tokens from circulation, the entire economic model collapses under the weight of its own success.

The Deflationary Imperative

Modern game developers have learned from these mistakes and now implement deliberate deflationary pressures. These mechanisms work similarly to central bank policies in traditional economies but operate through transparent, algorithmic rules encoded in smart contracts. The goal isn't simply to reduce token supply but to create a careful balance where token acquisition feels rewarding while maintaining scarcity that preserves value.

Core Deflation Mechanisms

One prevalent approach involves burning tokens through in-game transactions. Every time players upgrade items, unlock special content, or participate in certain activities, a percentage of tokens gets permanently removed from circulation. This creates constant buy pressure as players need to replenish spent tokens while simultaneously reducing overall supply. The burn rate often adjusts dynamically based on circulating supply metrics, creating an automated balancing act.

Another innovative method ties token burns to governance participation. Guilds that stake tokens for voting privileges see a portion of those tokens burned over time, effectively making governance participation both a right and a deflationary mechanism. This elegant solution aligns the interests of active community members with the health of the overall economy.

Multi-Layered Sink Systems

Advanced models employ cascading sink mechanisms that operate at different tiers of the economy. At the micro level, individual player actions trigger small burns. At the guild level, collective activities might activate larger deflationary events. Some systems even incorporate periodic "halving" events similar to Bitcoin's model, where token emission rates decrease according to a predetermined schedule.

These layered approaches prevent single points of failure in the deflationary design. If one mechanism proves insufficient during certain market conditions, others can compensate to maintain equilibrium. The most robust systems include fail-safes that automatically intensify deflationary measures when certain inflation thresholds are breached.

Behavioral Economics in Deflation Design

Successful models incorporate principles from behavioral economics to make deflation feel organic rather than punitive. Instead of simply taking tokens away, systems create engaging sinks that players willingly participate in. Limited-time cosmetic upgrades, exclusive content gates, and competitive leaderboards tied to token burns all serve this purpose. The psychological effect transforms deflation from an abstract concept into an exciting part of gameplay.

Some projects have taken this further by gamifying the deflation process itself. Special events where communities compete to burn the most tokens for rewards have proven particularly effective. These create viral participation while achieving significant supply reduction in short periods.

Dynamic Adjustment Mechanisms

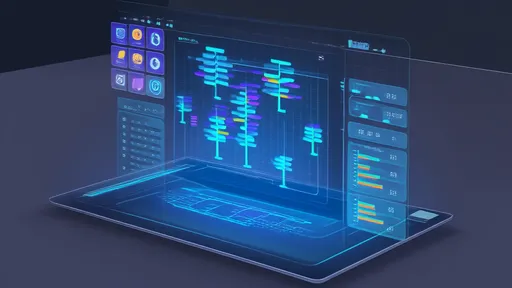

The most sophisticated systems now incorporate machine learning algorithms that analyze dozens of economic indicators to adjust deflation parameters in real-time. Token velocity, holder distribution, marketplace activity, and even external market conditions all feed into these models. This allows for nuanced responses impossible with static rule sets.

However, developers must balance automation with transparency. Players need clear visibility into how and why deflationary adjustments occur to maintain trust in the system. Many projects now publish real-time dashboards showing exactly which mechanisms are active and their current intensity levels.

The Role of Governance Tokens

In mature guild ecosystems, governance tokens often serve as the deflationary counterpart to utility tokens. While utility tokens circulate freely for everyday gameplay, governance tokens become increasingly scarce through locking mechanisms. This creates a dual-token dynamic where one facilitates transactions while the other preserves long-term value.

Some designs allow governance token holders to vote on deflationary parameters, creating a decentralized feedback loop. When the community directly benefits from maintaining token value, they tend to make more conservative decisions about inflation controls.

Challenges and Considerations

Implementing effective deflationary models requires careful calibration. Overly aggressive deflation can stifle new player onboarding by making entry costs prohibitive. Conversely, insufficient deflation leads to the same inflationary death spirals these systems aim to prevent. The ideal model maintains just enough scarcity to preserve value while keeping the economy accessible.

Another challenge involves communicating complex economic concepts to players unfamiliar with tokenomics. Successful projects invest heavily in education, using visual aids and simplified explanations to help users understand how their actions impact the broader economy.

The Future of Guild Token Models

As blockchain gaming evolves, deflationary mechanisms will likely become more sophisticated and interconnected. We're already seeing early experiments with cross-game burning mechanisms where tokens burned in one title affect economies in partner games. This interoperability could lead to entire networks of games supporting each other's economic health.

The next generation of models may incorporate predictive elements, anticipating market movements and adjusting deflationary measures preemptively. Some developers are exploring ties to real-world assets and commodities to create more stable valuation baselines.

Ultimately, the guild token deflation models proving most successful are those that view the economy as an integral part of gameplay rather than just a supporting system. When players intuitively understand how their participation shapes economic outcomes, they become active stakeholders in maintaining balance. This alignment between player incentives and ecosystem health represents the holy grail of sustainable game economies.

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025

By /Aug 15, 2025